When Are Taxes Due In 2020? Here’s What Families Need to Know

It's still a good idea to get them in early.

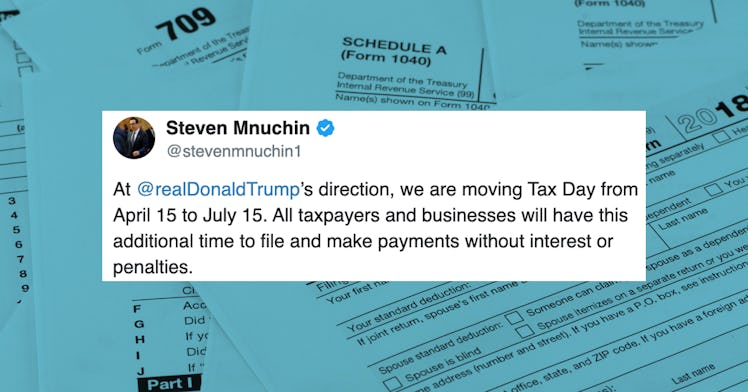

The deadline for businesses and individuals to file their federal income taxes has been delayed for three months. Instead of April 15, you’ll have until July 15 to file your 2019 income tax return. The highly unusual move comes in response to the coronavirus pandemic.

Treasury Secretary Steven Mnuchin announced last Tuesday that the deadline to pay any taxes owed to the government was moving to July 15, but he was adamant that the filing deadline would remain the same. On Friday, he reversed course.

The IRS followed up with a press release that offered more specific information.

“Taxpayers can also defer federal income tax payments due on April 15, 2020, to July 15, 2020, without penalties and interest, regardless of the amount owed. This deferment applies to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate tax filers as well as those who pay self-employment tax.”

So no matter what kind of federal income tax you file, you have extra time to prepare it. But that doesn’t mean that you should necessarily take advantage of it. IRS Commissioner Chuck Rettig encouraged taxpayers who were owed a refund to file as soon as possible and to file electronically to get their money as soon as possible.

Despite interruptions to other aspects of its operation — Taxpayer Assistance Centers are closed and face-to-face service discontinued indefinitely — Rettig maintained that the IRS continues to promptly process returns.

“Although we are curtailing some operations during this period, the IRS is continuing with mission-critical operations to support the nation, and that includes accepting tax returns and sending refunds.” And even in the wake of brutal Republican-led budget cuts, most tax refunds are still being issued within three weeks of the filing date.

Crucially, Mnuchin’s pronouncement does not affect state filing deadlines. Some states have already delayed theirs, and more will likely follow now that the feds have done so, but you should check your state to make sure you don’t miss one deadline just because another was pushed back.

This article was originally published on