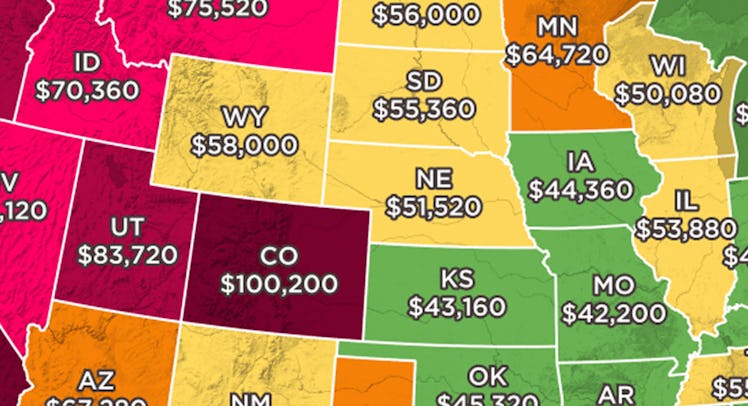

This Map Shows How Much You Need To Make To Afford The Average Home In Every State

Look at your own risk.

HowMuch, a website aimed at helping people understand money, put together an infographic that illustrates just how much your annual salary needs to be in every state if you’re interested in buying an “average” home in that state. The results might make you squirm.

Unsurprisingly, the East and West Coasts are home to the most expensive, well, homes in the United States. In California, you need to make more than $120,000 a year in order to buy an “average” home. Meanwhile, over in Michigan, the least expensive, you need to make $40,000. In Hawaii, which tops the list, you need to pull in $153,000 a year to buy a home — the average cost of which is more than $600,000.

HowMuch collected the data by scouring real estate website Zillow. They then plugged those prices into a mortgage calculator, determined monthly mortgage payments, and, working on the assumption that buyers contribute a 10% down payment, constructed their map. They calculated the salaries by operating under the official recommendation of financial advisers that homebuyers should not purchase a home that costs more than 30% of their gross income.

While much of the map is not a shock, there were some surprises: Researchers found that it’s easier to buy a home in Pennsylvania than Wyoming, despite that out West there is far more available land for homeowners to purchase.

Of course, researchers also noted that within each state there’s a significant variance in home-ownership costs, depending on location. In Colorado, for instance, the map shows that you need to make more than $100,000 dollars a year in order to afford a home. That’s largely because of the Denver-area housing market, where the cost of living is much higher. The same is true of New York, where homes upstate are far more affordable than those in the city.

So, take these prices with a grain of salt. But your best bet is to head out of the city and into the heartland.

This article was originally published on