This Map Shows Where Prices are Rising Fastest – But You Don’t Have to Panic

Paying more for gas sucks, but it's a sign of a stronger, fairer economy. Here's why.

The prices for a lot of different things, from gas to food to rent, are rising. While inflation is not a good thing, especially for parents trying to make ends meet, there’s no reason to panic. That’s because, when you zoom in on the issue, you can see that inflation is uneven, and when you zoom out on the issue, you see that even with inflation, the economic situation now, compared to a year ago is dramatically, inarguably better.

Economics is an inherently complicated field, and the various interests of the people in the debate can cloud the issue even further. Here’s what families should know about the current inflationary period and why things aren’t as bad as they seem.

Inflation is uneven geographically…

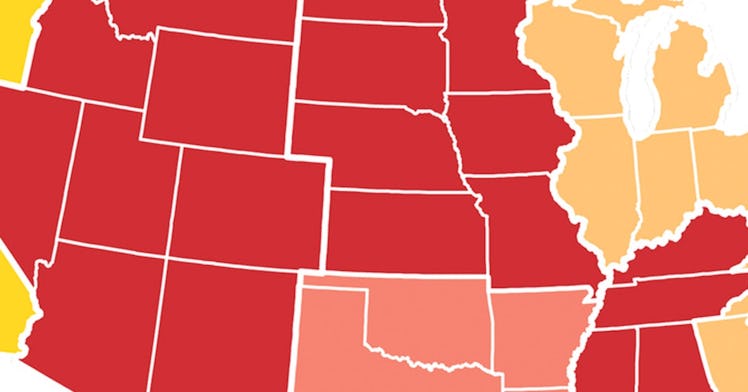

The Wall Street Journal assembled a map using data from the Department of Labor that shows how much the consumer price index has increased in each state in the past year. (Check out their map here.) In New York, Pennsylvania, and New Jersey inflation is around five percent. It’s slightly higher in New England and on the West Coast, and slightly higher still in the Great Lakes and most of the southeast. The quartet of Texas, Oklahoma, Arkansas, Louisiana are just off the highest rates, around 7.5 percent, that are happening in the Great Plains, Southwest, and the western half of the South.

…and across different commodities.

But even if you live in the areas of the country where inflation rates are the highest, you still might not be all that affected by it. That’s because the latest data shows categories that range from the price of some products increasing by 59.1 percent since last October (fuel oil) to some products dropping in by 0.4 percent drop in prices (medical care commodities).

That being said, gasoline prices that jumped by nearly 50 percent compared to a year ago are behind much of the price increases across categories. Unfortunately, though he is getting a lot of the blame, there isn’t much Joe Biden can do in the short term to lower the price of gas and, by extension, all of the products that it’s used to deliver.

Today’s inflation is largely the result of people having more money to spend.

Those who lived through previous, poorly managed inflationary periods are understandably sensitive. But the overall economic situation, despite the negative effects of inflation, is definitely improving from the lows of the pandemic.

Clauida Sahm, a senior fellow at the Jain Family Institute and former Federal Reserve economist, spoke to Vox about why now is not the time to panic.

Her main argument is that much of the inflation that’s happening now is a result of people having more buying power than they did in the earlier days of the pandemic. Unemployment is finally falling, which means more people are taking home paychecks. The economic relief provided by the federal government is also helping things, particularly for the working class.

People with low incomes, even if they are making the same amount of money that they were at the beginning of the pandemic, have more to spend thanks to the stimulus checks and child tax credit. And some of those that did lose low-income jobs actually made more receiving unemployment insurance than they did working for a sub-subsistence minimum wage.

“Low-income people have more in liquid assets, more in wealth, than they have had in a very, very long time,” Sahm says. “Prices are rising, but their bank accounts rose faster.” And a society in which people are complaining about having to pay higher prices is certainly more just than one in which many more people aren’t complaining about prices because they know they aren’t able to afford much of anything at all.

The bottom line…

Just as ensuring more Americans could survive the pandemic was more important than worrying about the potential inflationary effects of more people having money to spend, there are bigger problems now that are worth tackling even if they result in inflation.

The American Rescue Plan was worth the inflation it contributed to, and by the same token the Build Back Better Act—tackling climate change, improving education and childcare, making housing more attainable—is worth any inflation it might cause.

And no matter how bad inflation gets, no sane person would trade Christmas 2021, higher prices and all, for Christmas 2020, which many people didn’t celebrate because they had COVID, were mourning loved ones who died of COVID, or were simply terrified of seeing their families without the protection of a vaccine.

This article was originally published on