This Chart Reveals How Much Money Families Will Get From Stimulus Package

From good old fashioned stimulus checks to the expansion of the child tax credit into monthly payments, American families are going to become a lot more comfortable.

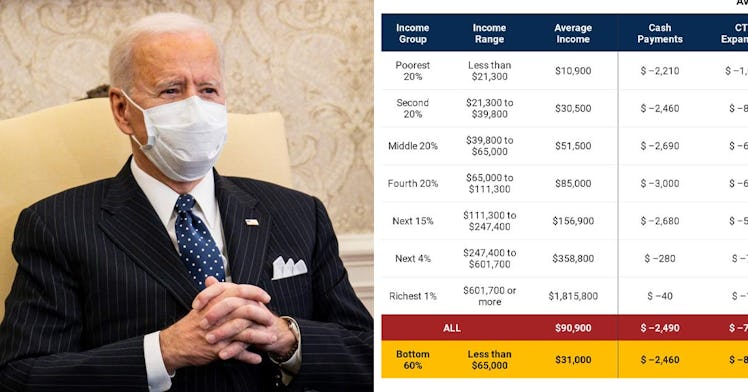

An economic institute did the math to figure out just how much American families at different socioeconomic levels would benefit from President Joe Biden’s stimulus package and the numbers are shocking.

Let’s face it: the $1.9 trillion in Joe Biden’s American Rescue Plan sounds like a lot of money because it is. The third round of economic impact payments to the tune of $1,400, the expansion of the earned income tax credits, and child tax credits to give parents monthly cash, means much of the benefits in the stimulus package will be in the form of cash that will make its way directly into the pockets of low- and middle-income Americans.

It’s a genuine anomaly in American welfare policy, and a true sign that American politics is changing. But exactly how much money folks at different income levels can expect to receive is a complicated question, and it’s one that has been answered.

Luckily, the Institute on Taxation and Economic Policy has a staff of people who do understand this stuff. They crunched the numbers and found out just what kind of an impact the package could make on various income brackets on average if, and when, it becomes law. The results are dramatic, to say the least. Keep in mind that this is an average — meaning that some families will receive much more in, for example, the expanded Child Tax Credit, and others won’t receive any of it at all. Either way, the average results are dramatic.

Let’s start with the poorest 20 percent of Americans, those who make less than $21,300 per year as a family. On average, their income is $10,900, and they would receive an average of $2,210 in cash payments, $1,060 in the child tax credit, and $320 in the earned income tax credit. That adds up to an additional $3,590, an astonishing 32.9 percent increase in income. That level of income increase is nearly astonishing — and a genuine indictment that in the wealthiest country in the world, people are forced to live with so little.

ITEP

Benefits for other income brackets aren’t quite as dramatic, but they’re still impressive. The second-poorest 20 percent of people, whose average income is $30,500, would get back $3,340, or 11 percent of their average income. The 20 percent making an average of $51,500 would get 6.6 percent of their income back, while that making $85,000 would receive 4.3 percent back.

All in all, the bottom 60 percent of Americans who make less than $65,000 and an average of $31,000 are in line for an average of $3,450 back from the stimulus payments and tax credit expansions, or just over 11 percent of their average income.

Now, there’s obviously a lot of diversity within each of these brackets. Some families will get a full on $3,600, or even thousands of dollars more, a year from the Child Tax Credit, for example, while other filers have children over 18 and won’t benefit from that aspect of the plan at all. Plus, certain aspects of the relief package — the additional stimulus payment for each dependent, for instance — means that there will be wild differences in the amounts received even by those with similar income levels who have more or fewer kids. Many people will receive much more than the average payment shown in these charts and many will receive less. But the chart is a decent way to begin to grasp the potential impact of the law on the country as a whole — and the results are dramatic.

You can see the complete charts on ITEP’s website.

This article was originally published on