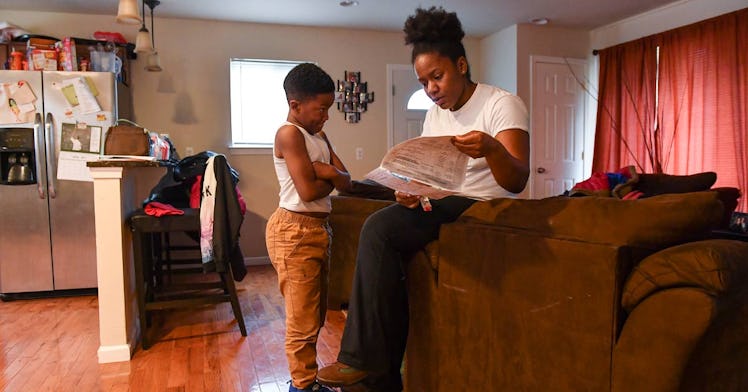

What Would Happen if Every Parent Received $374 Per Month, Every Month

According to one policy analyst, a lot of good.

There are Federal child benefit programs. But since those benefits — namely the Earned Income Tax Credit (EITC), the Child Tax Credit (CTC), and Additional Child Tax Credit (ACTC) — are a tangled mess of tax incentives embedded in our byzantine tax code, they’re hard to recognize as benefits and many of the families that need benefits most don’t take advantage of them.

Policy analyst Matt Bruenig has proposed a solution: scrap all three tax credits and send parents monthly checks instead. Through his thinktank the People’s Policy Project, Bruenig released the paper Now is the Time for an American Child Benefit, which argues that all parents, regardless of income, should receive monthly government payments of $374 per child, an idea modeled after successful programs in countries like Norway and Finland.

Fatherly caught up with the podcast host, father-of-two and husband of New York Times columnist Elizabeth Bruenig, to find out how the program would work.

What led you to write this paper?

I’d been thinking about the welfare state in general for a long time. I’ve written four or five papers on the welfare state generally. I wrote one called “Cleaning up the Welfare State.“ I went program to program and made little tweaks. But when it comes to child benefits, I don’t think tweaks are adequate for what really needs to be done.

The idea was to do a deep dive into these tax credits, which I don’t think people even conceive of broadly as the U.S. child benefit scheme. But it is our child benefit scheme. If you were to compare it to other countries, you’d say ‘oh that. That is the thing with the child benefits.’ It’s just really strange and obscure. And it’s complicated in the tax code.

That was the idea: simplification, more inclusion. Let’s fix this broken social safety net that we have in the U.S.

You write about eliminating the Earned Income Tax Credit (EITC), the Child Tax Credit (CTC), and Additional Child Tax Credit (ACTC). What’s the problem with them?

By their design, the rules of the program make it so lower income families are not eligible to receive the full benefit. Or in some cases those families are not able to receive any benefit at all. For all three of those tax credits, the bottom nine percent of kids in terms of income don’t get anything from those programs. And if you switch into different races, the bottom 16 percent of Black kids don’t get anything from those programs. As you move up the ladder, you get some benefits but you don’t get the full benefit. So the bottom 35 percent of children don’t receive the full tax credit, which is $2,000 per kid. You have to be in the top 65 percent. For the EITC, it’s the bottom 20 percent that don’t get the full amount.

Beyond that, there are a lot of people who are eligible who can not figure out how to get these benefits because they’re complicated. If you have a low income, you may not owe any tax. And you may know that you don’t owe any tax. But even though they don’t owe any tax, they need to file a tax return so that they can get a tax refund. And since they didn’t pay any tax, they’re not getting refunded. We just call it a tax refund. It’s actually a benefit. It’s very confusing.

It’s very difficult for a lot of people to figure this out. We know from the census data that one in five people do not apply for the Earned Income Tax Credit. Even the ones that are eligible. We don’t have similar data for the Child tax credit or the Additional Child Tax Credit. But they’re essentially the same program so I’d expect that if you didn’t figure the EITC, you probably didn’t figure out how to file for the ACTC.

Since they’re tax credits, you receive it once a year. They don’t help in the short term.

Yes. It comes at the end of the year, so you don’t get it until maybe 12 or 15 months after you really need it. Your income can be very different in the next year. Not only is the timing off, getting payments that are periodic as opposed to lump sums, helps incorporate the money into a budget.

Joe Biden has said he wants to increase the child tax credit from $2,000 to $3,000 and make it not phase in, so it’s 35 percent. At the moment, there’s a little bit of debate about whether they’re going to do this monthly or not, but it seems that right now they’re not. And so no one will get paid out until February of 2022 at the earliest, which doesn’t really help with what anyone’s facing right now.

Why are you proposing monthly payments?

It’s not going to be a tax credit in the tax code that you have to file in a really confusing way and has a phase-in and a phase-out. It’s means-tested and so forth. All that gets cleared up and you have a very simple program that you can explain to anyone, which is: you have a kid, you get $374 a month. It’s very easy. $374 a month. I don’t care what your income is. It’s just going to come to you and once the thing gets going, I think it should be administered through the Social Security Administration. When you have a kid, you get a Social Security Number at the hospital. And that’s all you gotta do. You don’t need to report your income every single year. You do it once and you’re good to go.

What do you mean when you say means-tested and why might that be a bad thing?

Right now, if you earn a certain amount of money and you go beyond a certain threshold, they start reducing your benefits. The Child Tax Credit one is the easiest one to understand. Every dollar you earn above $200,000, they reduce your child tax credit by five cents until you go down to zero. That’s the basic idea.

They’re trying to reduce the benefit for people who have an income over a certain amount. There are a couple of problems with that. But the big one is that in order to administer a means test, or an income test as it’s sometimes called, everyone has to report their income. So it doesn’t just affect rich people, it also affects anyone who can not successfully report their income. And that’s true of a lot of poor people who have very unstable incomes and or incomes from odd jobs like baby-sitting or other things you don’t get pay stubs for.

There are a lot of situations where people don’t have good records of their income. And people might not be able to navigate the process even if they do. Some people can’t read, some people don’t speak English. So the more tests and conditions you put on it, the harder it is for people, even the people you want to reach, to successfully apply to the program.

So the worry is that people who are too rich to need these benefits would get them but the effect is that it often excludes poor people.

Right. The more hoops people have to jump through, the more people are going to fail to jump through the hoops, even people you want to reach. And that’s what we see already with the Earned Income Tax Credit. Over one in five people who should get it don’t because they don’t successfully jump through the hoops. So you want to reduce the hoops and make the hoops as easy as possible.

The second thing is that I think we should at least question the wisdom of saying that affluent people shouldn’t receive the benefit. Think of other benefits that we pay out in our society, to disabled people, to elderly people, to people who are unemployed. With those programs, it doesn’t matter how much your spouse makes or how much the person you live with makes.

For children, the logic is still the same. This child doesn’t work. Why would you base it on the income of their parents?

Part of the point of these benefits, not just the child benefits but the disabled and the unemployed, is to smooth out peoples’ incomes over time. When you’re unemployed, it plugs the gap and you’re good to go. Children have the same effect. Even if you’re affluent, you have a kid, your expenses go way up. You’re now having to pay $20,000-plus just for childcare, let alone diapers and the rest of it.

If you’re worried about affluent people having too much money, we have a way to solve that problem, which is through the tax code. You can just raise their taxes.

And rich people are certain to file taxes, unlike the people you were talking about earlier.

Exactly. You don’t have to pursue it on the benefits side. We can stick it to the rich on the tax side. Then everybody gets the benefit.

Where does the $374 figure come from?

I went to the federal poverty guidelines and looked at what they say you need for the poverty line for a one-person family and what’s the poverty line for a two-person family. And if you take the difference between those, you get $4480. Divide that by 12 you get $374 once you round up a little bit.

With this benefit being paid out, no family will ever go into poverty because they add a child to their family. There will still be people who are poor. But they’re not going to be poor just because they added a child to their family.

Would this replace other social services for parents and children?

No. You need both. You need an income benefit and you need childcare benefits. I have another paper called the Family Fun Pack where I lay out other benefits.

We need free healthcare for kids. Kids don’t pay for their own healthcare as it is. So it makes sense to spread that cost out across the entire society instead of concentrating it only on parents who are often young and don’t necessarily have a lot of money. So free healthcare for kids, free childcare for kids, just like we have free K through 12 education. Those, and paid leave, are the big ones. When you have a kid, all those things are still necessary, but this is just solely for covering diapers, food, clothes, you know, maybe you have to get another room for your apartment or whatever. It won’t be enough to solve all the other costs you might have.

How does your experience as a father inform your research?

I was actually writing about this stuff before I had kids. So I don’t think it’s really been too informative. I guess my views haven’t changed. Mostly, I’m interested in the welfare state. This idea really just comes out of reading about what other countries do. This is how they handle it in Denmark or Finland or Norway. They just send everyone a check every month and it works great.