Tax Season Advice: The Tax Deductions All Parents Should Know

New baby? Medical expenses? Child care? Mortgage interest? There's a lot that can be deducted.

I became a dad earlier this year. Things have been going great. But tax season is making me anxious — or more anxious than it has in year’s past. My main question is about deductions, which, to me, are rather confusing. In terms of the big picture, how do I know if it makes sense to itemize or claim a standard tax deduction? What about tax exemptions? I know many were largely phased out in the Tax Cuts and Jobs Act but are there any left? I also did some work to my home this year (renovating a new baby room). Is this a tax write-off? And what about new-parent tax deductions and credits? I know this is a lot but can you offer some advice when it comes to tax deductions? What should I consider and what should I disregard? Thanks in advance. — Ryan, via email.

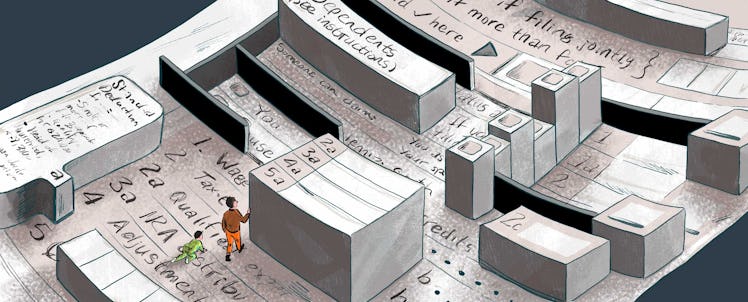

Congrats, man—and don’t worry. A lot of new parents get that deer-in-the-headlights look when tax season rolls around. It’s no wonder. There are more twists and turns in the IRS code than there are in Parasite. I’ll see if I can’t help simplify things a bit.

The Tax Cuts and Jobs Act, or TCJA, did limit some deductions (more on that in a moment). But, perhaps more importantly, it made the act of itemizing deductions obsolete for a giant swath of the population. That’s because it nearly doubled the standard deduction.

Whereas itemizing reduces your taxable income based on meeting certain criteria, the standard deduction is sort of a catch-all that you can use in lieu of itemizing. For the 2019 tax year, single filers and married people who file a separate return, you can deduct $12,200 from your income. If you file a joint return with your spouse, you can deduct $24,400.

The only reason you’d want to go through the pain of itemizing is if your various deductions total more than those amounts. That’s not the case for most folks. The Tax Foundation predicts that only about 13.7 percent of filers will itemize on their 2019 return, less than half of the percentage who would do so had the TCJA never been enacted.

Tax Deductions: To Itemize or Not to Itemize

Even if you’re pretty confident that the standard tax deduction is the better bet, I’d advise you to do some back of the envelope calculations, just to be sure. Now, the reality is that a lot of people are going to use tax software that figures this out for you. True enough. But tallying up your “would-be” itemized expenses is a useful exercise for two reasons:

- It helps you better understand the tax code and how to reduce your liability going forward

- You want to make sure the software catches all of your relevant expenses.

That said, here are some of the more common itemizable deductions you’ll want to figure out.

State and local taxes (SALT): You can deduct your property taxes, plus either your state/local income taxes (including any that came out of your paycheck) or sales taxes you paid during the year. The TCJA capped the deduction at $10,000, much the chagrin of people living in expensive, tax-laden parts of the country.

Mortgage interest: Here’s another biggie for homeowners. Under the TCJA, you can deduct the mortgage interest on up to $750,000 of principal from a first or second home — or up to $1 million, if you bought it prior to December 15, 2017. In many cases, you can also deduct any prepaid interest, or points that you paid when you bought the home. Typically, your lender will send you a Form 1098 that lists these amounts for you.

Charitable contributions: Hopefully you kept the receipts if you made payments to the Red Cross or your local food pantry last year. You can deduct any contributions you made to a tax-exempt organization, which can help put you over the standard deduction hump.

Medical expenses: For 2019, you’re allowed to itemize medical costs that exceed 7.5 percent of your adjusted gross income. Now, that’s a pretty high bar in most cases. But for someone who just had a baby and experienced the insanity of U.S. healthcare costs, you might just trigger this one. It sounds like your son or daughter arrived in 2020, which means all of those birthing expenses won’t count this tax season. But doctor visits or tests that your wife received last year can go on your 2019 return, if they surpass the 7.5-percent threshold.

Those are just the more common ones. The list of deductions is too long to include here, but it consists of everything from gambling losses to expenses you incurred if from a natural disaster. If you’re in doubt about whether any expenses you paid last year qualify for tax relief, it doesn’t hurt to look them up.

Tax Credits and ‘Above the Line’ Tax Deductions

The tax deductions I already mentioned are ones you can only claim if you itemize. But there are also so-called “above the line” tax deductions that you can use to chip away at your tax bill, even if you use the standard deduction. Those include things like student loan interest, contributions to a traditional IRA, moving expenses for a new job, and the part of the self-employment tax that’s deductible.

Also included in that grouping: contributions to a health savings account (HSA). If you or your spouse happen to have had a high-deductible health plan last year, you have until the tax filing deadline this year to make contributions for 2019. It’s a good way to save a little on your medical costs, even if you used the standard deduction.

You can also snag credits, including a couple important ones geared toward parents, regardless of whether or not you itemize. One that will definitely help cushion the blow of all those new baby expenditures is the Child Tax Credit, which went up to as much as $2,000 per kid after the TCJA (though it’s lower if you exceed certain income limits).

Unlike deductions, credits reduce your tax liability on a dollar-for-dollar basis, which means a $2,000 credit actually decreases the amount you owe (or increases your refund, as the case may be) by $2,000. The Child Tax Credit, in particular, is Uncle Sam’s way of throwing you a bone after shelling out a small fortune to bring a new child into the world.

Another credit you might want to look into, if you and mom both work, is the Child and Dependent Care Credit. If you paid someone – be it a babysitter or a daycare– to care for a child under the age of 13, you can likely get some relief.

When determining the size of the credit, you’re allowed to include up to $3,000 of qualifying expenses for one child or $6,000 for two or more children. The portion you’re actually allowed to claim as a credit is between 20 percent and 35 percent of these expenses, based on your income.

So, yeah, it’s a bit confusing, but well worth your time if you shelled out a lot of dough to have someone watch your baby while you headed to the office. Just be aware that you can’t use the credit for expenses you already paid with pre-tax money from a Flex spending account.

Alas, you may notice that I haven’t mentioned anything about nursery renovations. Unless you run a daycare and can claim it as a business expense, the IRS isn’t going to give you any relief for that one. But here’s hoping you qualified for enough other breaks to get a nice fat check from the Treasury Department anyway.