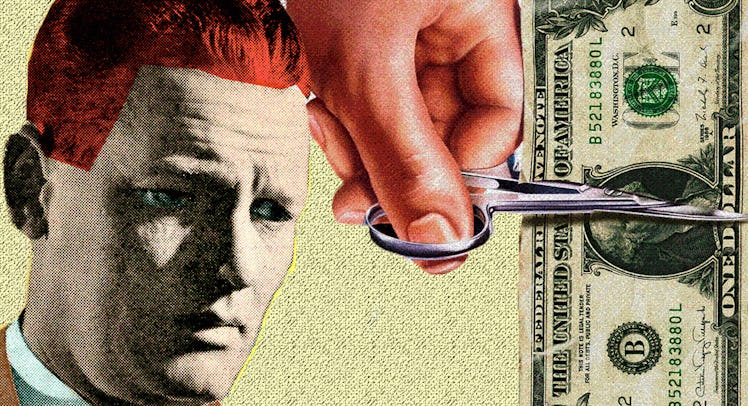

The New Tax Law Could Make Divorced Parents Pay Up

The bill will repeal the alimony deduction, and both parties will feel the pain.

As if getting divorced wasn’t unpleasant enough, the recent tax bill could make it even uglier.

The Tax Cuts and Jobs Act will take away the deduction for alimony payments, starting next year. As a result, experts say divorce proceedings will likely become more complicated and costly.

The rule won’t affect anyone who’s started paying alimony by December 31, 2018 – they’re grandfathered in. (L3) But for divorces thereafter, higher-earning spouses won’t be able to write off the amount they send to their former partner. And that could dramatically change how divorce settlements are reached.

Smaller Alimony Payments?

The current IRS rules take advantage of the fact that alimony payers are typically in a higher – sometimes much higher – tax bracket than their ex. That difference can be even more pronounced when one of those individuals brings home a large paycheck.

Take, for example, a man who earns $300,000 and pays a marginal rate of 35 percent on his federal return. If he starts paying alimony this year, he’ll get a 35 percent tax break on the alimony he pays each month. So if he pays $40,000 a year to his former wife, he’ll save $14,000 on his tax bill.

Because of the changes, divorce attorneys will have to try splitting up a smaller pool of money. In a lot of cases, that will result in less spousal support for the lower-earning spouse.

When negotiating the terms of a divorce, attorneys often exploit the difference in tax status for the benefit of each client. The settlement accounts for the fact that the higher-earning spouse benefits from the deduction. And because of that, the other spouse often gets a larger check. In other words, both parties share the tax benefit.

That’s all changing in 2019. Because of the changes, divorce attorneys will have to try splitting up a smaller pool of money. In a lot of cases, that will result in less spousal support for the lower-earning spouse.

The fallout could be even harder for less affluent divorcees, according to some experts. Without the deduction, the major breadwinner in the relationship can claim they have fewer financial resources. “The deduction, as it stands, is a great motivator to encourage the higher wage earner to agree to help support the spouse with less income,” family law attorney Randy Kessler told MarketWatch.

The tax bill will potentially impact not just divorcees, but couples who are preparing to walk down the aisle. Most prenuptial agreements include language about the alimony the spouse with greater income will pay in the event of a divorce. Now, attorneys will have to factor in the lack of a tax deduction in order to protect their higher-income clients.

Recapturing Lost Revenue

So why repeal the deduction? In part, it’s a way to help make up the budget shortfall that the GOP bill will likely exacerbate. However, given the size of the corporate and individual income tax cuts contained in the legislation, eradicating the alimony deduction hardly makes a ripple.

The Congressional Joint Committee on Taxation estimates that the law, in whole, will increase the national debt by $1.5 trillion over the next decade. Yet taking away the alimony deduction will only put an estimated $6.9 billion back into government coffers.

There are other reasons Republicans have targeted the alimony deduction, however. It’s a provision that’s seen its fair share of abuse over the years. Roughly 361,000 individuals claimed the deduction on their 2015 tax returns, according to IRS data. Yet only 178,000 taxpayers indicated that they received such payments.

Some have even argued that the deduction creates an incentive for couples to split up rather than work on their relationship. GOP members of the Ways and Means Committee called the policy a “divorce subsidy” because “a divorced couple can often achieve a better tax result for payments between them than a married couple can.”

It remains to be seen whether scrapping the tax break will save any marriages. But with the write-off expiring at the end of December, couples already on the outs could be racing to see their lawyer.

This article was originally published on